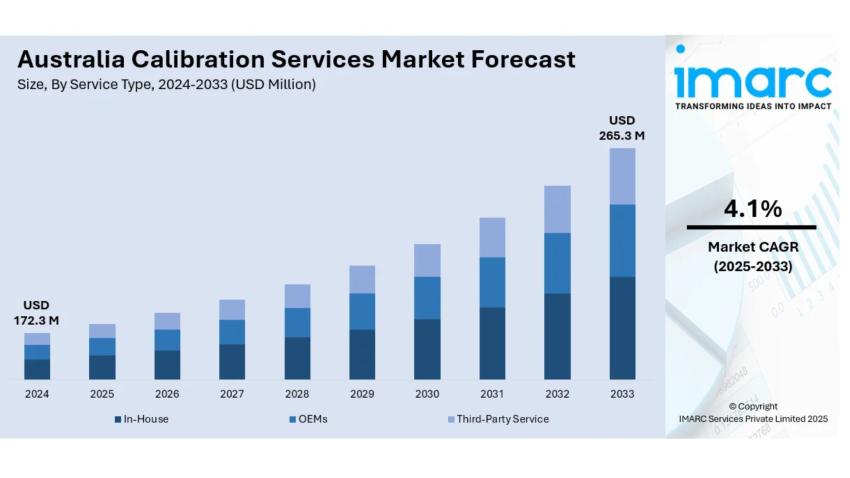

The latest report by IMARC Group, titled “Australia Calibration Services Market Size, Share, Trends and Forecast by Service Type, Calibration Type, End Use Industry, and Region, 2025-2033,” offers a comprehensive analysis of the Australia calibration services market growth. The report also includes competitor and regional insights, along with a detailed segmentation of the industry. The Australia calibration services market size reached USD 172.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 265.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025–2033.

- Base Year: 2024

- Forecast Years: 2025–2033

- Historical Years: 2019–2024

- Market Size in 2024: USD 172.3 Million

- Market Forecast in 2033: USD 265.3 Million

- CAGR (2025–2033): 4.1%

Australia Calibration Services Market Overview

• The market is growing steadily because more industries are using automation and better quality control practices.

• Companies in Australia are regularly using calibration services to follow strict rules and safety guidelines.

• More industries, such as automotive, aerospace, electronics, and medical, are needing very accurate tool checks.

• The National Measurement Institute (NMI) and other labs approved by NATA in Brisbane, Adelaide, and Perth offer highly accurate calibration for measurements like weight, length, and volume.

• More companies are choosing one place for all their calibration needs to run their operations more smoothly and stay compliant.

Key Features and Trends of Australia Calibration Services Market

• Companies are using calibration to keep their instruments working properly and measurements accurate, which helps ensure safety and follow rules.

• There's a bigger move towards having one main place that offers all calibration services, which helps cut down on equipment downtime and makes it easier to manage the process.

• Newer, more precise equipment is driving the need for better metrology services.

• Businesses are choosing automated systems that work with software to make it easier to track equipment and create digital reports.

• Third-party service companies and original equipment manufacturers are expanding to different regions to meet the growing need for calibration services locally.

Growth Drivers of Australia Calibration Services Market

• More industrial automation is happening, so there's a bigger need to regularly check and adjust process control instruments.

• Rules and ISO standards are making it necessary to have very accurate measurements.

• High-precision manufacturing areas like aerospace, defense, and semiconductors are growing in Australia.

• More companies are using remote monitoring and systems that predict when maintenance is needed, which means sensors and tools need regular calibration.

• More lab networks and mobile calibration services are being set up to provide help on-site across different sectors.

Innovation & Market Demand of Australia Calibration Services Market

- Market players are launching one-stop, multi-disciplinary calibration labs for mass, dimensional, thermal, and electrical measurements.

- Digital traceability platforms are being implemented by calibration providers to enhance report management and audit readiness.

- Service models are evolving with subscription-based and as-a-service offerings, aimed at reducing overhead costs for industries.

- Technological integrations with IoT and cloud-based platforms enable real-time calibration validation and remote supervision.

- Growing emphasis on zero-defect manufacturing is increasing reliance on precise calibrations for product quality.

Australia Calibration Services Market Opportunities

- Opportunity to expand on-site and mobile calibration services to underserved regional areas and industrial parks.

- High growth potential in medical devices and energy sectors, requiring highly specialized calibration of life-critical and utility infrastructure.

- Demand is surging for automated calibration solutions integrated with asset management software for predictive maintenance.

- Competitive edge for service providers offering fast turnaround times, flexible contracts, and custom calibration packages.

- Partnerships with industry bodies and educational organizations open new avenues for training, certification, and research collaborations.

Australia Calibration Services Market Challenges

- High costs associated with advanced and multi-type calibration equipment and skilled labor.

- Maintaining consistent calibration standards across diverse industries and regulations.

- Limited awareness among SMEs about the long-term cost savings of regular calibration.

- Shortage of qualified technicians can delay testing schedules and affect service quality.

- Increasing pressure to offer real-time digital calibration validation while maintaining human precision.

Australia Calibration Services Market Analysis

- Competitive landscape is fragmented but growing, with OEMs, third-party labs, and in-house facilities vying for market share.

- Market is evolving with digital calibrations, paperless certification, and automated asset recording systems.

- Industry 4.0 practices are encouraging predictive maintenance strategies, boosting demand for calibration across all sectors.

- NATA and NMI continue to play crucial roles in standardizing accuracy and driving adoption across Australia.

- Key cities like Melbourne, Sydney, Perth, and Adelaide remain calibration service hotspots, due to industrial concentration.

Australia Calibration Services Market Segmentation:

By Service Type:

- In-House

- OEMs

- Third-Party Services

By Calibration Type:

- Electrical

- Mechanical

- Thermodynamic

- Physical/Dimensional

- Others

By End Use Industry:

- Electronics Manufacturing

- Communication

- Aerospace and Defense

- Automotive

- Others

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Calibration Services Market News & Recent Developments:

- April 2022: Trescal launched a centralized, single-source calibration solution in Australia and New Zealand, enhancing precision measurement support across industries.

- 2024: NMI expanded its capabilities in high-mass standards and introduced enhanced mobile labs serving automotive and aerospace sectors.

Australia Calibration Services Market Key Players:

- Trescal

- National Measurement Institute (NMI)

- Endress+Hauser

- ABB Calibration Services

- WIKA Instruments

- SIMCO Electronics

- Intertek Group

- SGS SA

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- COVID-19 Impact Analysis

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Segment-Wise Forecast and Opportunity Assessment

- Market Drivers and Success Factors

- SWOT and Competitive Analysis

- Market Structure and Value Chain Insights

- Comprehensive Company Profiling and Positioning

🔍 FAQs: Australia Calibration Services Market

Q1: What is the current market size of the Australia calibration services market?

A: The market reached USD 172.3 Million in 2024.

Q2: What is the expected market size by 2033?

A: The market is projected to reach USD 265.3 Million by 2033.

Q3: What are key factors driving market growth?

A: Growth is driven by industrial automation, regulatory compliance, growth in precision manufacturing, and increasing demand for equipment reliability.

Q4: Which calibration type is witnessing rising demand?

A: Electrical and mechanical calibrations dominate, followed by thermodynamic and dimensional calibrations.

Q5: What industries are increasingly adopting calibration services?

A: Key sectors include aerospace & defense, electronics, automotive, healthcare, and manufacturing.