India Used Car Loan Market Overview

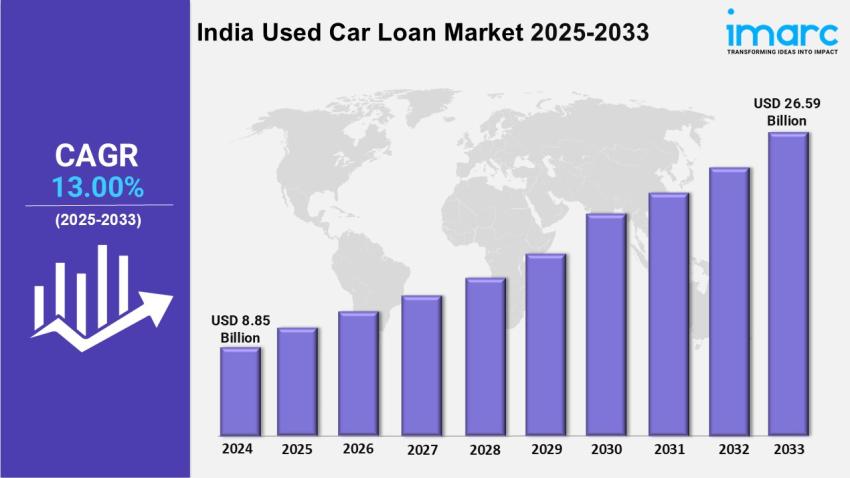

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 8.85 Billion

Market Forecast in 2033: USD 26.59 Billion

Market Growth Rate: 13.00% (2025-2033)

The India used car loan market size was valued at USD 8.85 Billion in 2024 and is expected to reach USD 26.59 Billion by 2033, exhibiting a growth rate (CAGR) of 13.00% during 2025-2033.

India Used Car Loan Market Trends:

Originally set-up, the Indian used car loan market is now undergoing turbulent changes due to changing consumer trends and financial innovations. An important trend is with the rise in demand for used vehicles as a price-sensitive set of consumers seeks value-for-money alternatives to newly purchased vehicles. On the digital lending front, such processes get momentum, and lenders still go through paperless functioning with approvals from AI credit assessments. Other conditions used to promote higher penetration of used car loans include fairly discount interest rates and easy EMI options for first-time car buyers and young professionals. Meanwhile, OEMs and dealership community all over the country are working toward getting certified pre-owned car programs up nationwide to instill trust and confidence in loan purchase.

Essentially, fintech companies are disrupting the traditional lending activities with customized loan offerings suited for a variety of credit profiles. In particular, tier-2 and tier-3 cities appear to be emerging hubs of growth, supported by developing financial literacy and dealership infrastructure. In addition to that, the integration of blockchain technology brings transparency to vehicle history checks, cutting down on potential fraud risks for lenders and borrowers alike. The market is also witnessing a surge in partnerships between NBFCs and online used car marketplaces, streamlining loan disbursals and creating seamless buyer experiences.

Read Full Report: https://www.imarcgroup.com/india-used-car-loan-market

India Used Car Loan Market Scope and Growth Analysis:

India's used car loan market is full of potential on account of urbanization and evolving trends in automotive ownership. The other thrust given to the loan sector is created by the increasing gap of affordability between new and used cars, affecting mainly the middle-income group. Organized chains of retail cars standardizing the classification of a vehicle and the financing options themselves, attracting institutional lenders, are some other contributing factors. Government schemes for financial inclusion are also enabling credit and, therefore, the purchase of used vehicles for some underserved sections. Therefore, growth in the working population with resultant aspiration-based growth in consumption is propping up demand for loan-financed used cars in urban and semi-urban markets.

Technology is another boost to the market through digital aggregators for loans and automated underwriting systems that cut operating time and opportunity cost. The sector is also witnessing the advent of innovation in product design such as subscription ownership and balloon payment schemes with increasing investment interest in auto-financing startups. Strategic partnerships between banks, NBFCs, and OEM-backed platforms are anticipated to continue democratize credit access and expand market reach. Overall, the convergence of demographic advantages, digital disruption, and regulatory support positions India’s used car loan market for robust, long-term expansion.

India Used Car Loan Industry Segmentation:

The report has segmented the market into the following categories:

Vehicle Type Insights:

- Hatchback

- SUVs

- Sedan

Financier Insights:

- Banks

- NBFCs

- OEM

Percentage of Amount Sanctioned Insights:

- Up to 25%

- 25-50%

- 51-75%

- Above 75%

Tenure Insights:

- Less than 3 Years

- 3-5 Years

- More than 5 Years

Regional Insights:

- North India

- South India

- East India

- West India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145